By law, information reported about you to credit bureaus must be fair, ac curate, relevant, substantiated and verifiable. Through our simple but powerful process, we help to ensure that credit companies can't abuse these standards.

WE'VE BEEN SUCCESSFUL AT REMOVING:

LATE PAYMENTS

CHARGE OFFS

BANKRUPTCY

MEDICAL BILLS

COLLECTIONS

FORECLOSURES

TAX LIENS

STUDENT LOANS

INQUIRIES

CREDIT ERRORS

AND MORE!'

24/7 ACCESS TO YOUR CLIENT PORTAL

Results in 30-45 days

(there has been a delay with the credit bureaus due to COVID-19)

Starter Package

$125 to start, $99 Monthly Fee.

INCLUDED

Credit Education

3 Bureau Audit-Analysis

24/7 Client Portal Access

Customer Service Support

Monthly Updates on portal

Credit Building

This service is flexible and offer clients the ability to cancel at any time with no fee. Agreement is voided and repair stops if monthly fee is not paid by due date.

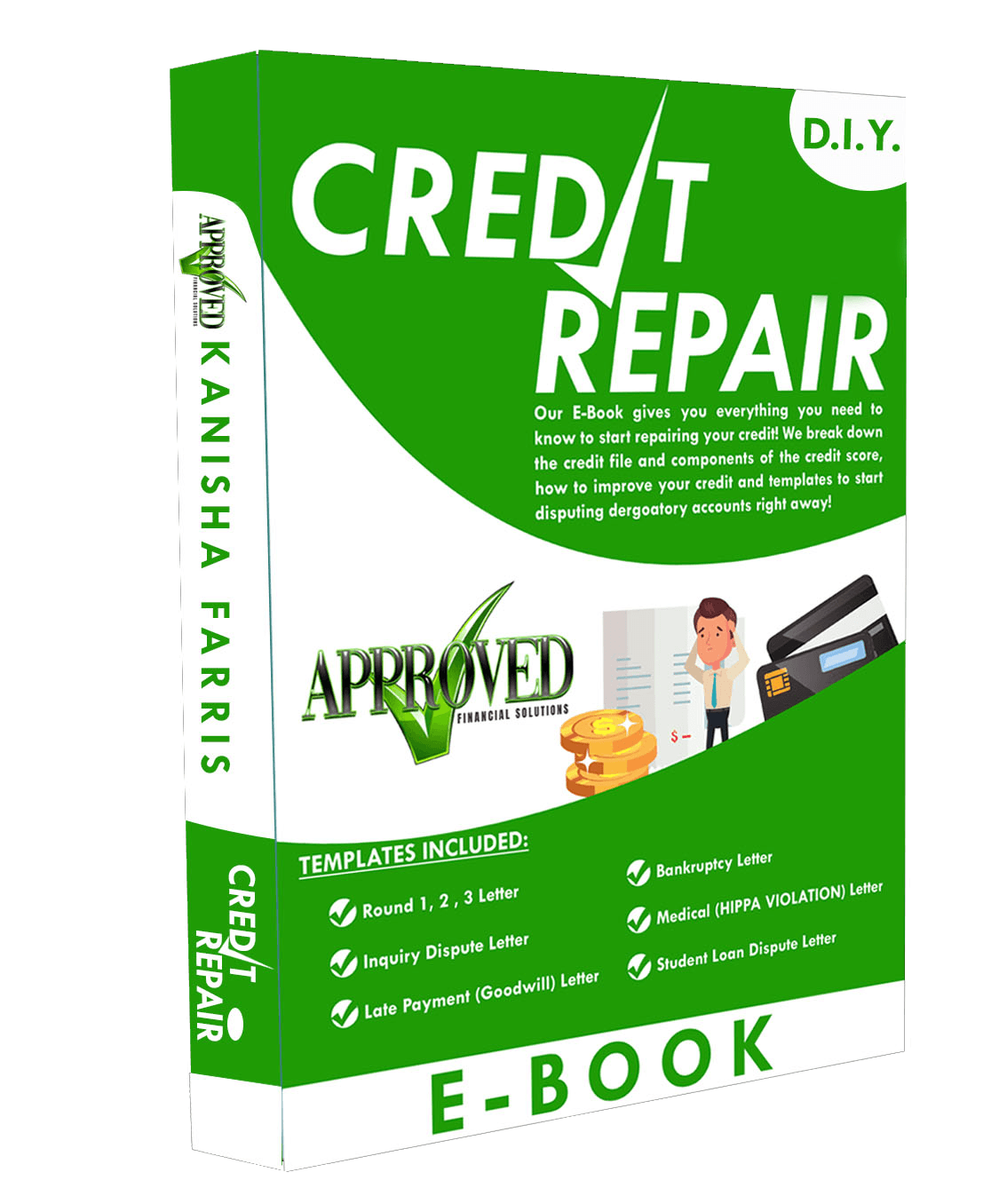

Do It Yourself Credit Repair

E-BOOK

Credit Repair E-Book

Our E-book gives you everything you need to know to start repairing your credit! We break down the credit file, components of the score, how to improve your credit and templates to start disputing derogatory accounts right away!

INCLUDED

Credit Repair E-book

TEMPLATES

Round 1, 2, 3 letter

Inquiry dispute letter

Late Payment (Goodwill) Letter

Bankruptcy Letter

Medical (HIPPA Violation) letter

Student Loan dispute letter

Interested in adding a Temporary TRADELINE to your credit profile? Click

HERE

for more details!